A

Abandonment by the tenant, Accessories to the rental agreement, Agency fees, Animals

C

Capital invested, Change of owner, Co-ownership

D

Death of the owner, Death of the tenant, Destruction of the property, Discount,

Duration of rental

E

End of rental statement, Energy performance certificate (CPE), Eviction,

Expertise

F

Fire, Fully equipped kitchen, Furnished flat, Furniture

H

I

Indexation clause, Individual flatshare, Insurance, inventory of fixtures

L

Lease contract, Lessor’s privilege

M

O

P

R

Rent, Rental charges, Rental guarantee, Repairs

S

Statement of charges, Shared flat,

Subletting

T

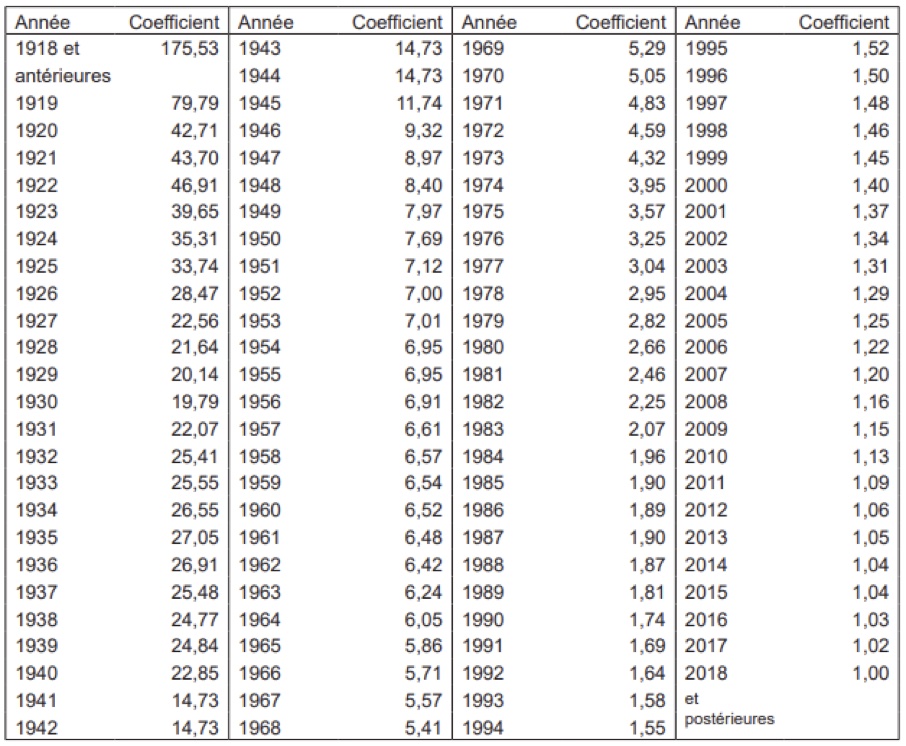

Table of revaluation coefficients, Termination

V

Abandonment by the tenant

If the tenant abandons the property, the rules are the same as in the case of the death of the tenant.

Accessories to the rental agreement

These are, for example, the garage or car park, or the cellar. If these accessories are not mentioned, but the tenant has free access to them, and if they are indicated in the inventory of fixtures, then it is presumed that they are part of the lease.

Ventilation

Ventilation (together with the correct use of heating) is important to avoid mould in the flat. This is especially true in older, less well insulated buildings without mechanical ventilation.

Ventilate several times a day (2-3 times as a general rule), leaving the windows wide open, especially in the bedrooms, kitchen, laundry room and bathroom, i.e. where humidity is higher. The duration of ventilation can vary according to the season. The colder it is outside, the less time you need to ventilate (in winter: 4 to 6 minutes; in summer: 20 minutes or even more, except during heat waves). If you create a draught by opening several windows, you can even ventilate for shorter periods.

Animals

Opinions among lawyers may differ and such a dispute depends, if at all, on the judgment of a judge. A clause strictly forbidding an animal may not be valid. On the other hand, a tenant would be required to seek permission from the landlord. But in any case, if a pet bothers the neighbors, the tenant is at fault. It would therefore be important to reach an agreement between landlord and tenant, or to find out in advance whether a pet is to be kept.

Insurance

The rental agreement may oblige the tenant to take out insurance against rental risks. But even without such an obligation in the lease, it is strongly recommended to do so.

Personal need

Personal need is one of the reasons that can be invoked by the landlord to terminate the contract. The law provides for specific procedures and deadlines, including the 6-month termination period. If the landlord does not occupy the accommodation within three months of the termination or eviction of the tenant, the tenant may claim compensation.

The letter of termination for personal need must mention the text of Article 12(3) of the Residential Tenancies Act of 21 September 2006, which reads as follows:

(3) By way of derogation from Article 1736 of the Civil Code, the period of notice in the cases provided for in paragraph (2), point a, is six months. The letter of termination must be in writing, must state the reasons for the termination and must be accompanied, where appropriate, by relevant documents and must be sent by registered letter with acknowledgement of receipt. It must mention, under penalty of nullity, the text of this paragraph.

Within three months of the notice of receipt by post, the tenant may, under penalty of foreclosure, request an extension of the termination period from the Justice of the Peace. In the absence of such a request, the lessor may ask the justice of the peace for a decision authorizing the forced eviction of the lessee after the expiry of the six-month termination period. However, the tenant may still apply for a stay of execution of the decision, in accordance with Articles 16 to 18. In this case, the tenant must vacate the dwelling no later than 15 months after the date on which the letter of termination of the lease is sent. The decision authorizing the forced eviction of the tenant will not be subject to opposition or appeal.

In case of a request for an extension of the termination period, the parties will be summoned within two months to a hearing. Unless the request is seriously disputed or contested, the justice of the peace will grant an extension of the time limit to the tenant provided that the latter proves before the expiry of the initial six-month time limit, by means of documents, either that he is in the process of building or converting a dwelling belonging to him, or that he has rented a dwelling that is being built or converted, or that he has taken useful and extensive steps with a view to finding new accommodation. The extension of the time limit may in no case exceed twelve months from the date of expiry of the initial six-month period. The deferral favor provided for in Articles 16 to 18 shall no longer apply. The decision granting or refusing the extension of the time limit shall be deemed to be an enforceable title with a view to forcibly evicting the tenant after the expiry of the time limit. It is not subject to opposition or appeal.

Moreover, if a legal entity (e.g. a trading company) invokes personal need, it must provide evidence that the rented property is essential for its activities.

Capital invested

The annual rent cannot exceed 5% of the invested capital. This rule does not apply to subsidized housing, such as SNHBM and the Housing Fund.

The invested capital is determined by adding the investments of the following elements:

- he purchase price of the land on which the dwelling is located; if the price is not known, the owner may choose to add to the capital invested a flat-rate estimate of 20% of the total expenses for construction/acquisition and improvements;

- the construction of the dwelling or the purchase of the dwelling (including incidental costs, such as notary fees);

- major improvements, e.g. renovations, extensions, conversions, construction of balconies or terraces, installation of a new kitchen.

Caution: In the case of the purchase of an existing dwelling (i.e. the owner was not the builder), the purchase price in the notarial deed is assumed to be the revalued and discounted invested capital.

Revaluation of invested capital

When a new lease is concluded, or when the rent is changed, the capital invested is revalued.

This is done by consulting the coefficient table and revaluing all the elements separately (construction/purchase of the dwelling, purchase of the land, improvements). Each item is multiplied with the coefficient for the year in which the investment was made and then all items are added together to determine the revalued investment capital.

Examples of improvements to be included in the calculation of the investment capital:

- Renovations, extensions, alterations;

- construction of balconies or terraces;

- installation of a new fitted kitchen.

Discount

From 15 years after the construction of the house, and every two years thereafter, a discount is applied to the revalued invested capital. This is an incentive for owners to invest in housing.

The discount is calculated from the revalued invested capital without the price of the land. If the owner has carried out maintenance and repair work since the construction/acquisition (not to be confused with improvement work!), excluding daily maintenance (or any maintenance to be carried out by the tenant). If these expenses exceed the amount of the discount, the rest is compensated with the next discount.

If the investment capital cannot be determined because of lack of evidence, and if even after a sworn expert assessment there is disagreement between landlord and landlady, the rent board can be called upon to assess the investment capital.

Calculation examples

Example A: Acquisition of an existing flat

Let’s assume that in 2021 an owner wants to rent out a flat that he bought for 400.000 euros in 2010 (including notary fees etc.). In 2020, he has had a new fitted kitchen installed for 15.000 euros.

To calculate the capital invested, proceed as follows:

| Flat | 400.000 x1,13 (coefficient for the year 2010) | = 452.000 |

| Kitchen (improvement) | 15.000 x1,00 (coefficient for the year 2020) | = 15.000 |

| Total | 467.000 |

Assuming that the construction of the flat was completed in 2010, a discount is not yet applicable. Thus, the maximum monthly rent is:

(467.000 x 0,05) / 12 = 1.945,83 euros

Note: In the case of the sale of a dwelling, it is assumed that the purchase price in the notarial deed corresponds to the revalued and discounted invested capital.

Example B: With land (package), with improvements, with discount.

Suppose that in 2021, an owner wishes to rent a house built in 1995. The construction price was €350,000 (including all costs). In 2017, he has made improvements of €50,000. Let’s also assume that since the construction, the cost of maintenance and repairs amounts to 25.000 euros. The land is, in our example, calculated on a flat rate basis.

Let’s calculate the capital invested:

| House | 350.000 x1,52 | 532.000 |

| Improvements | 50.000 x1,02 | 51.000 |

| Total | 583.000 |

For the lump sum price of the land, we assume that the 583.000 represents 80% of the capital invested, the remaining 20% being the price of the land:

Land price = ((583.000 / 80) x 100) – 583.000 = 728.750 – 583.000 = 145.750 euros

In calculating the discount, the price of the land is not taken into account. The house is more than 15 years old (26 years to be precise). Thus, the first discount of 2% is from 2010, then 2% for every two years (12% in total).

Discount = 583.000 x 0.12 = 69.960 euros

Without maintenance and repairs, the revalued invested capital would be:

(583.000 + 145.750) – 69.960 = 728.750 – 69.960 = 658.790 euros

However, the owner can claim repair costs of 25.000 euros. The discount finally applicable is therefore 69.960 – 2.000 = 44.960 euros.

The revalued and discounted invested capital is therefore

728.750 – 44.960 = 683.790 euros

The maximum monthly rent that the owner can charge is

(683.790 x 0.05) / 12 = 284.913 euros

Moreover, if the fees would have been higher than the discount to be applied – for example 80.000 euros instead of 25.000 euros – the discount would be fully compensated (i.e. no reduction). The difference between the fees and the discount (80.000 – 69.960) would be carried forward to the next discount.

Energy performance certificate (CEP)

The tenant must receive a copy of the certificate.

Change of owner

In principle, a change of landlord (in case of sale) does not affect the lease agreement, which continues with the new landlord and with the new details (address, bank number, etc.) that must be communicated to the tenant. The tenant does not have to pay a new rental guarantee.

Rental charges

The rental charges – i.e. those to be paid by the tenant – can only include those charges actually spent on behalf of the tenant. However, a clear categorization is not always obvious and requires knowledge of the reason for the charges or their nature. Charges related to common areas in a residence are proportional to the surface area occupied. Among the rental charges, we can mention in particular

energy consumption, lighting, water, heating, gas;

- routine maintenance;

- rental repairs;

- municipal taxes related to the use of the property (sewage, rubbish);

- lift;

- mailboxes;

- heating, lighting, water, gas;

- chimney sweeping;

- cleaning/maintenance of garden and yard;

- cleaning of common areas.

Please note: Management fees, meter rental fees and meter reading fees are to be paid by the landlord. Only in a particular case where management fees would have covered an obligation of the tenant or would have been incurred for the exclusive benefit of the tenant, the tenant is obliged to pay them.

Indexation clause

See Value clause.

Value clause

Sometimes a lease contract contains a value clause, i.e. the contract provides for a periodic adjustment of the rent e.g. according to the development of the consumer price index or the cost of living. Such clauses are prohibited.

However, if the tenant pays a higher rent as a result of the application of a value clause, he cannot claim a refund of the surplus paid. He must send a complaint to the landlord by registered letter with acknowledgement of receipt and can demand that the rent be brought back to the same level after the current term as before the adjustment. The value clause then loses its validity at the end of the current term.

Shared flat

For joint tenants (solidarity clause in the contract), the landlord can approach any of them to claim the rent. The one who pays the rent can then turn to the other tenants and claim their shares. The joint tenants must all fulfill their obligations until the end of the lease, even if one of the tenants leaves the accommodation (to go abroad, etc.). In the case of termination, all tenants must sign the letter. In the case of a termination by the landlord, the landlord only needs to notify one flatmate.

If there is no solidarity clause between the tenants, each tenant only pays his share. If only one tenant remains during the lease, he or she must pay the full rent.

Nor can a tenant claim a part of the rental guarantee if he or she leaves the accommodation.

Individual flatshare

In this case, an individual lease contract is concluded with each co-tenant. In no case is a solidarity clause possible. The conditions for termination and payment of rent are no different from those of a normal tenancy agreement.

Lease contract

A tenancy agreement can be oral or written, but a written agreement is strongly recommended. In the case of a shared tenancy, only a written contract is possible.

The lease contract must be made in as many copies as there are parties involved (in principle two: the landlord and the tenant). Moreover, in case of registration of the lease at the Administration de l’Enregistrement et des Domaines (which is no longer mandatory since 2017), an additional original of the contract is required.

It is recommended to include certain elements in a contract, even if their absence does not change the validity. These elements are, among others:

- Date of commencement of the lease;

- periodicity or date of payment of rent;

- inventory of furniture in the case of furnished accommodation;

- the landlord’s right of access;

- procedure for handing over the keys, inventory of fixtures on departure;

- description of the rented property, including annexes (cellars, laundry rooms, garage or parking space).

Co-ownership

A building may be governed by a co-ownership statute (defined and regulated by law). In these buildings, a distinction is made between private areas – the spaces intended for the exclusive use of an owner (or his tenant) – and common areas.

The co-owners must form a syndicate which acts for the community. Decisions are taken at a general meeting; the syndicate manages the common parts and establishes (or modifies) the rules of co-ownership for the building. This syndicate of co-owners must be administered by a syndic (a manager) who executes the decisions of the general assembly and acts as the legal representative.

In principle, a syndicate cannot prohibit the owner from renting out a flat or ask the owner to pay additional fees for renting out a flat. On the other hand, a clause in the condominium regulations prohibiting e.g. the letting of several rooms in the same dwelling to different persons can be considered valid.

As a general rule, the property manager sends the owner a detailed statement of the charges to be paid, including the charges that the tenant must pay to the owner. Often this statement already includes a categorization of the charges to be paid by the landlord and the charges to be paid by the tenant. However, the trustee cannot approach the tenant directly for the payment of the charges.

There is no direct legal relationship between the tenant and the syndic/syndicat de copropriété. The landlord is the main contact for the tenant (even for matters concerning the common parts) and can be held responsible to the syndicate for his tenant. The landlord is also obliged to transfer any information from the syndicate to the tenant when it may have an impact on the tenant’s use of the premises (e.g. works). The tenant, for his part, is obliged to respect the co-ownership rules.

At the tenant’s request, the lessor is required to provide him with a copy of the extracts from the co-ownership regulations concerning the purpose of the building, the enjoyment and use of the private and common areas and specifying the share of each category of charges for the rented lot.

Fully equipped kitchen

For one-bedroom dwellings, a kitchen niche is sufficient. For two or more bedrooms, a fitted kitchen of at least 8 m2 is required. For 5 or more occupants, a living room of 10 m2 is required, increased by 1.5 m2 per occupant; if the collective part of the dwelling includes a kitchen of at least 13 m2 (increased by 1.5 m2 per additional occupant), a living room is not required.

Death of the tenant

The lease continues for an indefinite period in favor of the spouse or partner who lived with the tenant; or the descendant or ascendant of the tenant if the person concerned declared domicile in the dwelling to the municipality at least 6 months before the death. Otherwise, the contract is terminated. If there are several applications, it is up to the judge to decide according to the interests expressed.

Death of the owner

The contract continues with the heirs of the deceased landlord. If the heirs are not known, or if the tenant does not know which heir to contact, he continues to pay the rent. If the account to which the tenant pays the rent no longer exists or is blocked, it is recommended that the rent be deposited (monthly) in a special account until an heir makes contact.

Statement of charges

The landlord must give the tenant an itemized account of the actual costs; normally such an account is drawn up once a year, but this can be determined by the parties. In any case, the tenant has the right to ask for a statement in order to verify the amount of charges he has paid.

End of tenancy statement

This is an obligation of the landlord who must give such a statement to the tenant at the end of the lease, or as soon as possible thereafter, following the general meeting of the co-ownership.

Discount

See Capital investment.

Eviction

See Termination.

Destruction of the property

The total destruction of the property (without influence from the lessor or the lessee) leads to the termination of the lease. In the case of partial destruction, the lessee may request a reduction in price or termination of the lease.

Owner’s right of access

The landlord has the right to visit the property once or twice a year to check the condition of the property. The tenant cannot refuse this right. Normally this right to visit is mentioned in the contract. The landlord also has the right to have interested third parties visit the dwelling in case of sale.

However, the landlord must agree with the tenant on the time and date of the visit in advance.

Duration of the lease

In the case of an oral lease, the duration is assumed to be indefinite.

In the case of a written lease :

- A contract may be for a determined period, but even at the end of the period fixed in the contract, if the tenant continues to enjoy the accommodation without notification from the landlord, a new (indefinite) oral lease automatically begins.

- A written lease may include a tacit renewal clause, for example from year to year. In this case, for termination, the term and the period of termination must be observed.

- A lease with indeterminate duration, oral or written, may be terminated at any time, but the termination periods must be observed.

Maintenance

See repairs.

Inventory of fixtures

An inventory of fixtures must be a document signed and made in duplicate that clearly lists the findings.

The obligation to draw up an inventory of fixtures is laid down by law as soon as a rental guarantee is requested. An inventory of fixtures at the end of the tenancy is not compulsory, but is recommended, especially to clarify the question of the refund of the deposit.

Expertise

According to the Residential Tenancy Act, a sworn building expert can be appointed to assess the capital invested, when there is disagreement between the tenant and the landlord and when there is a lack of supporting documents to determine the capital invested. A list of sworn experts can be found on the website of the Ministry of Justice.

If the valuation is seriously contested by one of the parties, proving that the expert’s valuation cannot correspond to the invested capital, then it is up to the rent board to assess the invested capital.

Fire

In the case of a fire in the rented accommodation (the private parts), it is the tenant who is presumed to be responsible, unless he can prove that the fire did not start because of his fault. This is one of the reasons why rental risk insurance is essential. If, in the case of a condominium, the fire broke out in the common areas, this presumption does not apply. Moreover, each dwelling must comply with minimum legal fire protection requirements (a fixed staircase for rapid evacuation, access to a second escape route, fire extinguisher on each floor, etc.).

Agency fee

The agency fee is set at a maximum of one month’s rent.

Rental guarantee (“deposit”)

The rental guarantee may not exceed the amount of 3 months’ rent. The rental guarantee can also be in the form of a bank guarantee. The landlord can only ask for a guarantee if it is clearly written in the lease contract.

The State offers tenants who do not have enough money to pay the rental guarantee to act as guarantor under certain conditions.

Furnished accommodation

See Furniture.

Rent

The rent can be adjusted at least every 2 years or whenever a new lease is concluded. A 2-year period does not end with a change of landlord, as the new owner has to wait for the end of the term. The annual rent may not exceed 5% of the invested capital.

Monthly rent = (invested capital x 0.05) / 12

If, as a result of a decision by the rent board or a court decision, the rent increases by more than 10%, this increase must be spread over 3 years.

Sometimes lease agreements contain value clauses. These are not valid. For more information, see value clause.

If the landlord wishes to increase the rent – which he can do every two years within the legal framework (see capital investment) – he must inform the tenant by registered letter. If the tenant refuses the increase and continues to pay the old rent, the landlord can refer the matter to the rent board.

Furniture

If the accommodation is not already furnished, the tenant is obliged to furnish it (see lessor’s privilege); in this case, it is furniture intended for habitation.

If the accommodation is already furnished, the annual rent takes into account the value of the furniture and may not exceed 10% of the capital invested.

A furnished room must have at least :

- A table;

- one bed with mattress per occupant;

- one chair per occupant;

- one individual piece of furniture for storing clothes per occupant.

Lessor’s privilege

In the case of non-payment of rent, the landlord has a lien on the tenant’s furniture, i.e. he can seize it when the rent is not paid. However, this lien is limited to the current year of the lease if the lease contract does not have a date certain.

Handover of the keys

For the handover of the keys, it is important that the tenant receives a certificate or receipt, or that the handover of the keys is mentioned in the inventory of fixtures on departure.

Repairs

There is a difference between rental repairs and more important repairs that the landlord has to pay for, of a conservatory nature. In reality, this distinction can lead to confusion. Sometimes the costs of repairing the same thing are for the account of either the tenant or the landlord: it depends on the context and the reason for the repair or maintenance.

All small repairs that are part of the routine maintenance of the equipment and the flat, and repairs of damage caused by the tenant himself, must be paid by the tenant. In principle, the maintenance or repair works to be paid by the tenant are for example:

- maintenance, cleaning and descaling of sanitary equipment;

- degreasing of equipment;

- preservation of seals;

- chimney sweeping;

- repairing holes in walls (e.g. made for hanging pictures);

- repairing doors and locks;

- replacing or repairing taps;

- replacing light bulbs;

- repairing household appliances in the kitchen.

All major repairs, repairs to the structure and substance of the building, repairs necessary for the tenant’s normal enjoyment of the dwelling (health, safety, hygiene), and repairs due to normal use and obsolescence must be paid by the landlord. Among the repairs to be paid by the landlord are, for example:

- renewal of wallpapers;

- floor coverings;

- roof repairs;

- repairs to deterioration due to the age of the building or force majeure;

- repairs to walls and vaults;

- repairs to the heating system;

- repairs/cleaning of gutters, downpipes, water pipes;

- repairs to sanitary installations.

In the case of urgent work, the landlord has the right to have it carried out immediately. In this case, the tenant may not request a reduction in rent if the work does not exceed 40 days.

Landlords are advised to keep proof and invoices of maintenance work and costs for the calculation of the capital investment. The tenant has the right to ask for this evidence when a landlord asks for reimbursement of costs that have been paid on behalf of the tenant.

Termination

The simplest method is termination by mutual agreement. In this case, the tenant and the landlord agree on the termination and the modalities without having to respect the relative clauses of the contract. In case termination is requested by one party, there are several legal and contractual rules and provisions to be respected.

For the tenant, the termination does not need to be motivated, but he must respect the termination period which is in principle 3 months. In the case of a fixed-term lease, he must respect the term provided for in the contract. In the case of a termination or a request for eviction by the landlord, the tenant can ask for an extension of the term, but he has to prove that he has made efforts to look for a new dwelling, or that he has rented or acquired a dwelling under construction.

For the landlord, termination can only be done in one of the cases provided for by the law: for personal need (termination period: 6 months), in case of non-compliance with the tenant’s obligations (the landlord can go directly to the justice of the peace for termination), or for other serious and legitimate reasons that the landlord must indicate (termination period: often 3 months). In the case of a fixed-term lease or a lease that is renewed for fixed periods, he must respect the term provided for in the contract. The tenant has the right to request an extension of the term.

Examples of serious reasons:

- Demolition of the building;

- major renovation and alteration works of real and objective utility; unless these works are such that the tenant could stay and if he accepts to live with the inconvenience;

- the accommodation of a person who takes care of the landlord;

- major alterations carried out by the tenant without permission;

- a manifest lack of good manners on the part of the tenant or loud and prolonged disturbances;

- non-payment of rent.

Termination for personal reasons must be done by registered letter with acknowledgement of receipt. The landlord must state the reason for the termination and include in the letter Article 12(3) of the Residential Tenancies Act 2006.

For other forms of termination, the law does not provide for any particular formality, but it is recommended to terminate by registered letter, unless this is a contractual obligation anyway.

At the latest three months after the end of the lease, the landlord must occupy the dwelling, unless there are renovation or conversion works. In principle, the case law also recognizes the right of the lessor to choose the most suitable dwelling when he has several.

An inventory of fixtures is not compulsory, yet it is strongly recommended to do so if there has already been an entry inventory.

An exit inventory of fixtures is done on the day the keys are handed over to the landlord (or to the agent acting on behalf of the landlord). The tenant must leave the flat in the same condition as it was at the beginning of the lease, except for damage or deterioration due to normal use or the age of the building.

Subletting

The landlord has the right to prohibit a sublet by a clause in the contract. A tenant who wishes to sublet the flat should first check whether the lease contract does not prohibit this. If subletting (which also includes renting via AirBnB) depends on the landlord’s permission, the landlord must give a legitimate reason for refusing.

Table of revaluation coefficients

The table of coefficients is established by the State Budget Act. It is necessary for the revaluation of invested capital. The table currently in force (state budget for the year 2019) is as follows: